Low Oil Prices: Mixed Impact in Tanzania

The large fall in the price of oil since mid-2014 is on the whole good news for Tanzania, which is a net importer of oil.

Indeed, Tanzanian stocks are around 40 percent higher than when oil prices began falling from a peak of $115 a barrel on June 19 last year, as the majority of larger listed companies operate in industries requiring significant fuel inputs. The price drop also helps to alleviate fuel poverty: most Tanzanians rely on charcoal and firewood, with only around five percent of the population having access to petroleum fuels according to World Bank figures, with catastrophic impact on the country’s forests. Many Tanzanian homes and businesses rely on backup fuel-run generators in the face of regular power outages, and pump prices have fallen by around five percent.

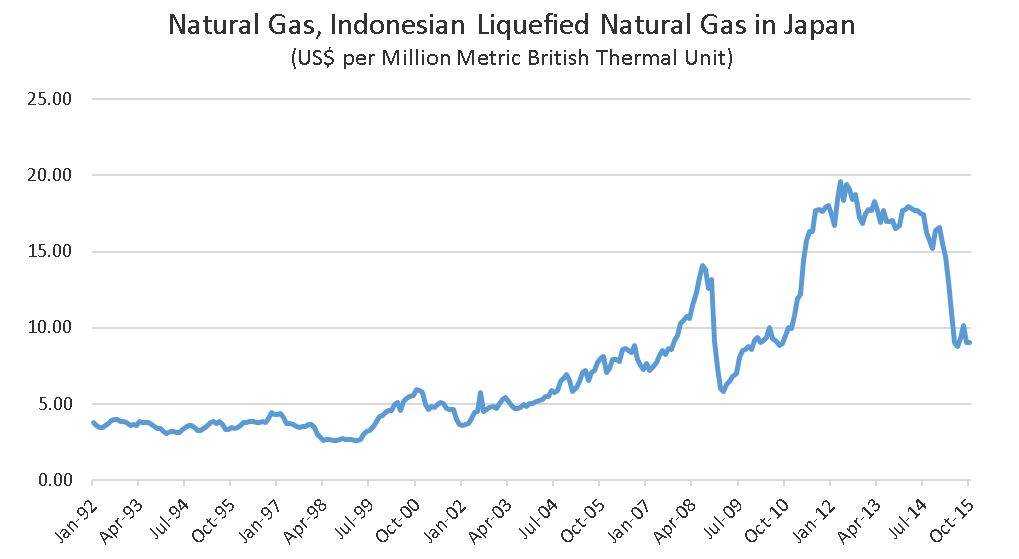

But looking beyond these immediate benefits, low oil prices could be a concern for the government’s economic strategy, which is partially based on recently discovered, very large natural gas deposits. As well as ensuring domestic energy needs are met, Tanzania could be exporting gas by as early as 2022, mainly to the Asian market, which currently prices its gas relative to the price of Brent crude oil. A fall in crude prices, along with the current environment in the LNG market, has caused LNG spot prices in the Asian market to fall by over 50 percent since May 2014 to $7.9 per million British thermal units.

So what are the immediate implications for Tanzania’s nascent offshore gas industry? The outlook for international oil companies (IOCs) is mixed. Companies such as BG state that the fall in prices is a short-term concern and will not significantly affect their investment plans in Tanzania. However some analysts point to a slowdown in exploration across East Africa and maintain that further falls or at least delays in capital expenditure are likely. Currently BG and Statoil plan to start production in 2022, following the construction of the required production infrastructure and LNG plant. The final investment decision, already delayed due to regulatory uncertainties and a constitutional review, could be pushed back further until future prices are more certain. If Tanzania’s government was hoping for a quick win on the new gas resources, this may come as a disappointment.

In addition to possible cuts and delays in capital expenditure, the industry is seeking to reduce costs in response to the fall in prices. Soaring costs on Australian LNG projects have been a beacon for the industry’s cost-cutting drive, while key figures in the Asian gas market have stressed the urgency of adapting and increasing efficiency in this regard.

Cost cutting will probably be good for Tanzania in the long run: a more efficient gas industry means that, when prices do increase, companies can make larger profits on a smaller cost base and there will be more for the authorities to tax.

But cost cutting could impact the Ministry of Energy and Minerals’ plans for local content in the gas industry. One of the government’s main goals for the sector is to maximize local content: ensuring greater numbers of Tanzanian businesses and workers can supply goods and labor to the sector to earn money and learn skills. This strategy may face greater challenges in the shorter term as ancillary suppliers will come under immediate pressure to lower prices and will therefore pass on these efficiency demands to next-tier suppliers. It will become harder for Tanzanian suppliers to compete with lower-cost suppliers from foreign markets. The government is already working with development partners to build local supply capacities in the gas sector, and the success of its local content strategy will depend on how efficiently these projects are implemented.

The price fall raises challenges for Tanzania’s gas sector, and mistakes by the government could mean wasting billions of dollars of Tanzania’s wealth. Arguably, the rate of gas discoveries has recently outpaced regulatory reforms. So a delay in projects and a slowdown in exploration could paradoxically be a blessing for the government, giving officials a chance to catch up and better prepare the country for when natural gas does start to flow.

Lee Robinson is NRGI’s Tanzania officer.