The Fiscal Regime for Uganda’s Mining Sector: A Need for Reform?

The Ugandan government has declared its intention to enact a new fiscal regime for the mining sector. This brief is a response to a request by the Ministry of Finance, Planning and Economic Development to review the prevailing regime and inform the government’s approach to revising it.

To attract much needed investment into the sector, the fiscal regime must be stable. It should therefore impose a tax burden that is neither too high nor too low.

Modeling of the current regime for a hypothetical gold project suggests that it has no critical weaknesses. It is not in urgent need of revision, and therefore the government could decide to focus its reform efforts on other areas. However, revising the fiscal regime may still be beneficial. While the regime appears to place a reasonable tax burden on larger, lower-cost mines, the higher tax burden faced by smaller, higher-cost mines could deter investment in these types of mines or encourage investors to request investment incentives from the government that lead to other challenges.

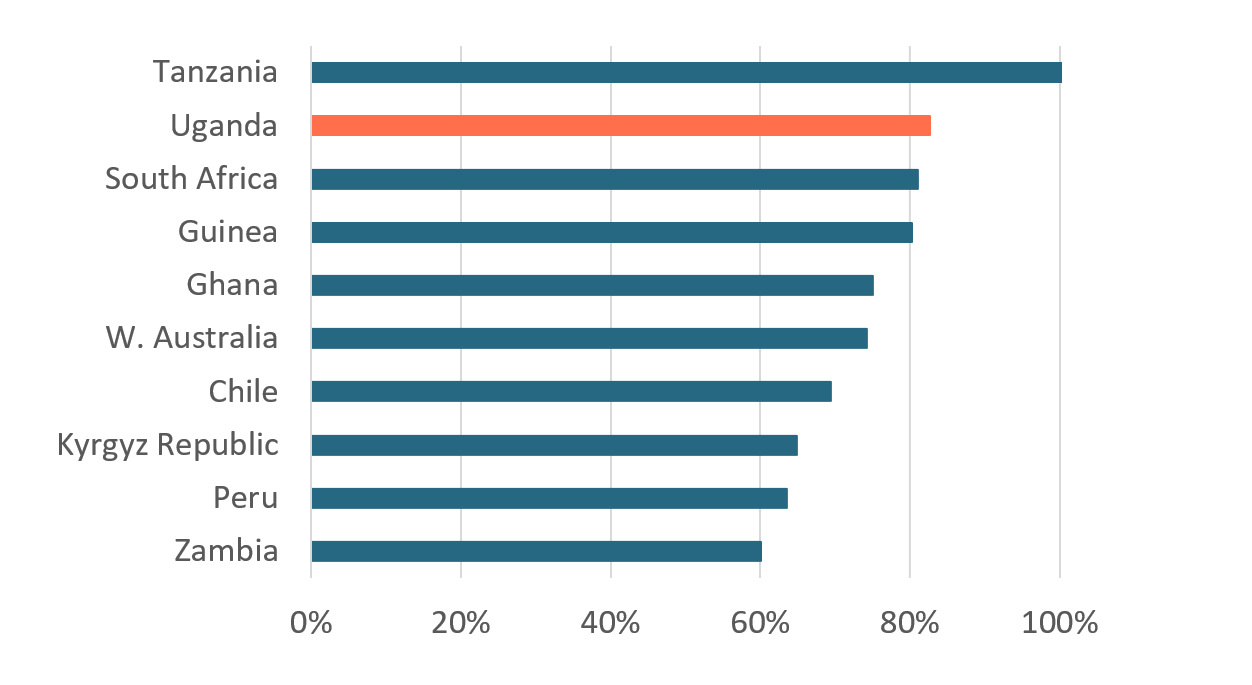

Average effective tax rate for model small mine with gold price of USD 1,300 per ounce

Considering these results, the author explores how the current regime could be revised to slightly reduce the tax burden imposed on small, high-cost mines, but without also reducing the tax burden imposed on larger, lower-cost mines. Making the regime more progressive in this way will require the government to compromise on at least one of its other likely objectives. The author concludes that of the four reforms analyzed, one that introduces either a variable rate royalty or a variable income tax could be the best option for Uganda.

This review is intended to merely demonstrate some of the options available to the government, however. The author only looked at one tax change at a time, and at only one version of that tax change. The author advises that the government evaluates the various possible combinations of tax changes before revising the regime.

The model and data used for this brief can be found here.

Authors

Thomas Scurfield

Africa Senior Economic Analyst