Forecasting Ghana's Oil Revenues: What Open Fiscal Modeling Tells Us About the Budget Year Ahead

Falling oil prices have had dramatic effects on the solvency of highly oil-dependent countries, particularly those that have not saved much of their windfall receipts in boom years. In November, Ghana’s finance ministry presented its 2015 Budget Statement and Economic Policy to parliament. The budget uses an estimate of petroleum prices at $99 per barrel. But on the day that the budget was proposed, Brent crude oil was trading at $80 per barrel. At the time of writing, prices have dropped even further to $60 per barrel.

Why would the finance ministry use a figure that now seems a fantasy? The discrepancy is based on a formula mandated by the Petroleum Revenue Management Act (PRMA) that uses a seven-year rolling average of past, current and expected oil prices. While we agree that it is crucial that the Ministry of Finance follow the law with regards to forecasting oil prices, the gap between the statutorily mandated benchmark price and the actual market trading price has nonetheless been a source of confusion for some parliamentarians and citizens.

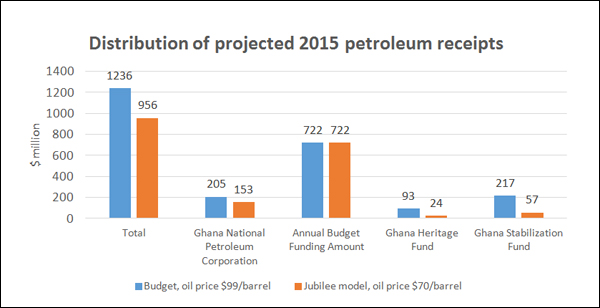

Ghana allocates petroleum revenue to several entities—the national oil company (the Ghana National Petroleum Corporation, or GNPC), a spending account for development priorities (the Annual Budget Funding Amount), and two sovereign wealth funds (the Ghana Petroleum Funds). To better understand the potential impact of falling prices on these areas in 2015, NRGI built an oil revenue forecasting model using publicly available data. Built in Microsoft Excel and released under an open licence, the tool can be edited, refined and updated as future events unfold in Ghana and the world.

What makes this modeling possible? The advanced state of oil sector disclosures in Ghana, for one. Key contracts from the Jubilee oil field are published, the country is EITI compliant, national laws require transparency and regular reporting, and international oil companies such as Tullow and Kosmos disclose further key information.

And what did we find? Our projections of petroleum revenues in 2015 suggest that by adhering to the Petroleum Revenue Management Act, Ghana can successfully cushion shortfalls from revenue volatility in 2015. Because the law mandates prudence when setting annual budgets, the government should be able to cover its commitment to the annual budget even if prices drop.

According to our analysis, if the Brent crude oil price were to trade at $70 per barrel throughout 2015, as opposed to the $99 per barrel benchmark price, actual petroleum revenue to the government would fall short by 31 percent, or $430 million, compared to our own estimate at $99 per barrel. As compared to budget figures, the shortfall is projected at 23 percent, or $281 million.

Our calculations show that the Annual Budget Funding Amount will be protected under a $70 per barrel price scenario. The shortfall in revenue would affect GNPC negatively, allowing it to withhold $52 million less in revenues (a 25 percent reduction). The accumulation of revenues into the two petroleum funds would slow dramatically under the $70 scenario: by our calculations, $24 million would accrue to the Ghana Heritage Fund in 2015 and $56 million would accrue to the Ghana Stabilization Fund. (In both cases this figure is 74 percent lower than what would be obtained in a $99 scenario.)

We recently presented our findings, alongside a list of questions on the 2015 budget, to Ghana’s parliamentary committees on finance and mines and energy. In turn, committee members have asked us important questions: Could higher production compensate for shortfall from lower prices? How does the cap on the Ghana Stabilization Fund affect the budget? What are the expected receipts from gas in 2015?

By making the model publicly available, engaged citizens can seek answers to such questions. We expect our findings to generate further discussion among government stakeholders, particularly at budget review hearings. This weekend NRGI will engage with the Public Interest and Accountability Committee, an institution created by the revenue management legislation to publicly monitor implementation of the law. And we will continue to engage with stakeholders to support effective planning and oversight of the budget throughout 2015.

The open model not only helps individuals understand the effects of petroleum revenues on the budget, but it also clarifies the dynamics of taxation from the Jubilee oil project, including petroleum contract implementation by the oil companies in the joint venture. If the model exposes a large shortfall in a particular revenue stream, that would flag the need for further investigation of revenues, costs and tax levies.

Despite our best efforts, this model still comes with serious limitations compared to those of government authorities, oil companies and international financial institutions like the IMF and the World Bank, who have access to proprietary or privileged information. Although we are confident that our model captures magnitudes and trends with a reasonable degree of accuracy, it may be less precise because it is based solely on public information. In a recent blog post, we called on international institutions to do more and release their models, making them open to the public.

We also hope that the model will provide grounds for collaborative work and learning. We will henceforth continue working with stakeholders in Ghana to refine the model and encourage disclosure of additional open data. No model is perfect, and we welcome feedback from readers. Please get in touch with us at [email protected] and [email protected].