An Analysis of Ghana's 2015 Oil Revenue Performance: Testing the Model

Ghana’s Minister of Finance recently presented the country’s 2016 budget, titled “Consolidating Progress Towards a Brighter Medium Term.” As the title of the budget reflects, 2015 has been a turbulent year for Ghana’s public finances. One setback was the continued drop in oil prices—a major shock since Ghana has been exporting petroleum since 2011. On top of this, the country also suffered a drop in the price of cocoa (its third-biggest export after oil and gold), and technical challenges with its gas and electricity infrastructure precipitating a major power crisis. But most importantly, the magnitude of debt, mostly accumulated following the oil discoveries, became so acute by last April that the IMF stepped in to bail Ghana out.

Almost exactly one year ago, when the previous budget was presented in parliament, NRGI built a revenue forecasting model to predict the effects of oil price volatility on the 2015 budget. When our analysis was published and presented to the budget committees, global oil prices had already started their rapid decline, with no indication of where they would stop. Back then, we illustrated how a price of $70 per barrel (the price at the time) would impact the budget as compared to the $99 per barrel benchmark used in budget itself—a price based on a five-year average, according to the legislated rules which govern how oil revenues should be allocated between oil funds and the budget.

We decided to not only publish our analysis, but to share the full model, including the data compiled from various different sources, and all simplifying assumptions used. We did this in order to enable users to recalibrate the model as oil prices changed and to allow for testing and challenging the assumptions used. Because no model is perfect, we believe opening it up allows for a more transparent and productive debate.

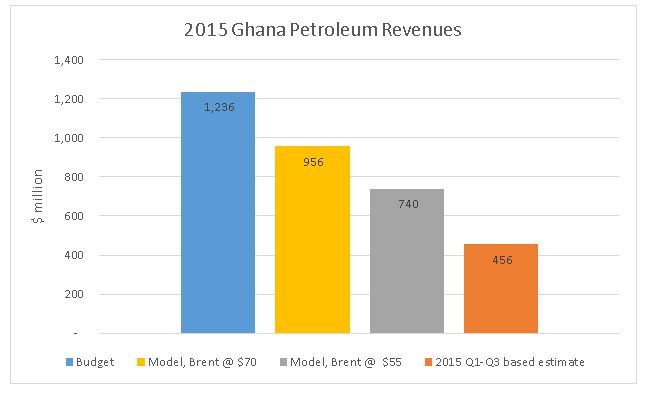

As the end of the year approaches, we have reviewed how petroleum revenues are performing and explored the implications for this year’s budget. Based on the preliminary information presented in the 2015 petroleum report by the Ministry of Finance (covering oil revenues between January and September), we estimated using a simple extrapolation that Ghana’s petroleum revenues for 2015 are likely to be $780 million (63 percent) lower than what was budgeted by the Ministry of Finance, and $500 million (52 percent) lower than we predicted with our own model at the end of 2014. This is a major difference relative to what the ministry had anticipated and what was possible to model with the information then available in the public domain.

The shortfall of $500 million compared to our own estimates (at $70 per barrel) can be attributed to three factors:

First, the larger-than-expected drop in prices. Brent crude has averaged $55 per barrel over the first 9 months of 2015—not the $70 we used in the model. The greater price change explains $216 million of the model’s shortfall.

Second, corporate income tax revenues were much lower than expected, accounting for $274 million of the shortfall after adjusting for the price drop. Our model assumed that companies would have recovered the initial development costs of the Jubilee field (Ghana’s main producing oil project, in the offshore TEN field) and that their taxable income would be lessened only by current operating costs. The very limited payment of any corporate tax by oil companies in the first nine months of the year indicates this is likely not the case. Last year, when we published the model, we flagged that possible deductions of development costs from neighboring projects are a major unknown in our corporate tax payment projection. We suspect that given the existing ring-fencing provisions in contracts, cost from neighboring TEN-field projects may have been offset against corporate taxes for Jubilee, therefore reducing the taxes due during 2015.

The third factor is related to the shortfall in gas revenues. Despite hopes of gas revenues materializing in 2014, the slow progress in setting up the infrastructure has led to delays in this revenue stream. Assuming no gas revenue materializes during 2015, as it has been the case so far, this leads to further $84 million shortfall versus what we had predicted.

Other revenue streams, such as royalties, the production share of oil going to government, and surface rentals are performing better than our model predicted and offset some of the shortfall.

Since we published the model, we learned a few important lessons from it and the related discussions with tax authorities, government and experts:

-

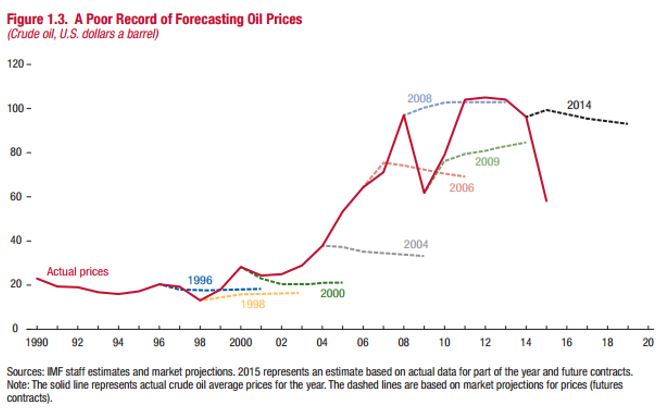

Predicting price is hard—forecasts therefore require constant updating.

When the analysis was done in response to a sudden drop in price in the fall of 2015, very few would have predicted that prices will stay this low for this long.

As the landscape changes radically, analysts need to check the validity of their forecasts and, where needed, update them. We are not the only one to update our model—the government also submitted a revised budget mid-year. Ghana’s government now projects oil revenues to be as little as 0.8 percent of GDP in 2018. What does this new (and gloomy) outlook rest on? When analyses are done behind closed doors, it is hard to check their validity or relevance in changing contexts; hence opening up models and assumptions is key.

-

There is a need for clarity in cost deductions.

There is no publicly available information on how much cost oil companies have offset against revenues from the Jubilee oil field. Of particular importance would clarity on how much of these costs relate to the Jubilee field itself and how much to other projects that are coming online in coming years. We suspect that a large share of current deductions relate to nearby projects under development, as detailed above. According to the contracts, the costs from projects in the same concession area can be deducted from taxable profits on the Jubilee project, in the absence of ring-fencing provisions preventing such practices. An ongoing audit by the Ghana Revenue Authorities will hopefully shed light on the amount affected and when these delayed revenues may materialize. A recently passed law will also address this problem for future projects.

-

Ad hoc changes to the rules are undesirable.

Since the publication of the model, the Parliament amended the rules on using petroleum revenues (originally set out in the Petroleum Revenue Management Act). According to the newly amended law, the government is allowed to revise the benchmark price which it uses to derive revenue distribution. It then lowered the benchmark mid-year, reducing the amount that the Ministry of Finance could legally spend from the stabilization fund. Our model was not designed to capture such within-year policy changes. But these ad hoc changes can also make planning and implementation difficult for government. The old rules on calculating the benchmark price were meant to help smooth revenues, mitigate volatility risks as well as risk of political interference in forecasting. While the exceptional circumstances resulting from the oil price drop may warrant adjustments to estimation procedure, this process must still be transparent, well-defined, absent of risks of discretion and ad hoc changes.

Building an open model and convening discussions around it provided some valuable learning, even when mis-forecasting occurred. We were able to highlight our concerns and potential reasons for the shortfall as part of conversations with officials at the Ministry of Finance, Ghana EITI and the IMF. The model enabled discussions by various civil society organizations on the impact of the oil price fall on Ghana’s petroleum revenues. It also informed our recommendations on amending the income tax and the petroleum revenue management laws. In terms of the way forward, we identified the key pieces of information we need to improve the robustness of our model. With the increasing importance of the TEN and Sankofa fields in next years, contract transparency and more clarity on cost deductions will be key to better monitoring of revenues.

Samuel Bekoe is NRGI’s Anglophone Africa regional associate. David Mihalyi is an NRGI economic analyst.