Facing the Future: What National Oil Companies Say About the Energy Transition

Key messages

-

National oil companies (NOCs) should publicly acknowledge the risk of the energy transition, assess this risk, and act by implementing mitigation plans.

-

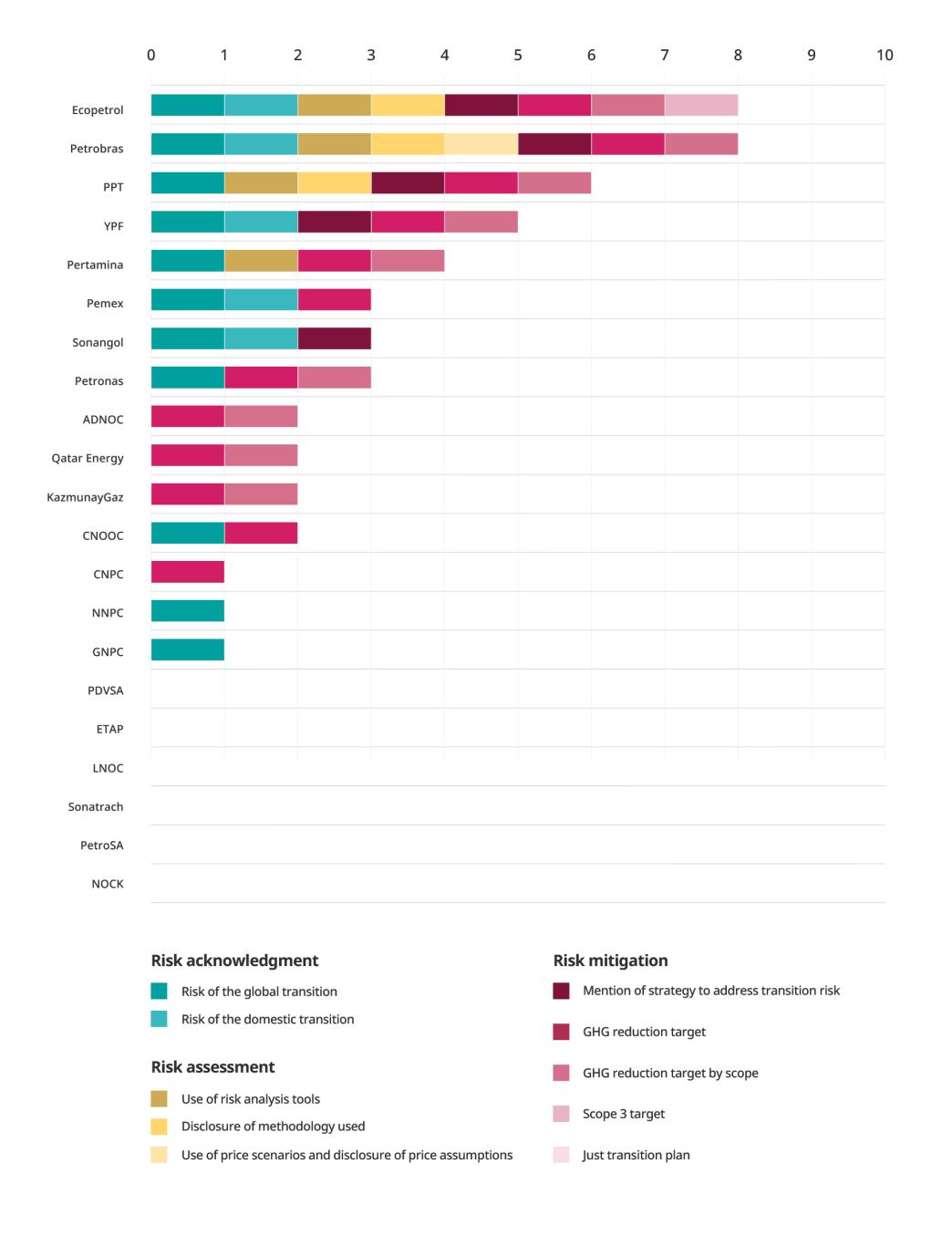

Only 9 out of 21 NOCs analyzed acknowledge the risk of the energy transition, 4 have mentioned the use of transition risk assessments, and 5 have explicitly mentioned strategies to mitigate the risk.

-

None of the NOCs have published “just transition plans” detailing how they will help workers and communities.

-

NOCs do not plan to decrease investments in risky oil and gas assets. Petrobras (Brazil), Petronas (Malaysia) and Sonangol (Angola) are divesting from less valuable assets, but not necessarily to mitigate transition risk or downsize operations.

-

Some NOCs, such as NNPC (Nigeria) and GNPC (Ghana), want to expedite drilling before oil and gas demand falls and acquire assets divested by other companies.

-

At least six NOCs intend to increase oil and gas investment to secure energy supplies.

-

Most NOCs intend to diversify, especially into gas, oil refineries, petrochemicals and renewable energy. However, it is unclear how much NOCs are spending on diversification or whether these are effective mitigation strategies.

-

NOCs can learn from each other. Two NOCs—Ecopetrol (Colombia) and Petrobras—are clear leaders in terms of recognition of energy transition risk. However, NOCs disclosing more transition risk information are not necessarily also those reducing higher-risk investments.

NOCs’ readiness to manage energy transition risk (based on public statements)

National oil companies (NOCs) produce half of the world’s oil, yet only recently have climate organizations considered NOCs a worthwhile area for advocacy.

Authors

Andrea Furnaro

Policy Analyst

David Manley

Lead Economic Analyst – Energy Transition