Surplus or Shortage? The Challenge of Setting a Domestic Supply Obligation for Tanzania’s Offshore Gas

One of the priorities of Tanzania’s new president is negotiating a way forward for the country’s long-planned offshore gas project. A key issue in this negotiation is the amount of gas that the government will take in the form of a domestic supply obligation (DSO). To increase the country’s energy supply, it wants a larger DSO than the currently agreed amount of around 8.5 percent of reserves.

This report analyzes the implications of a larger DSO for meeting Tanzania’s energy needs, for the offshore project and the government revenues it can generate. It builds on previous NRGI analyses by the authors.

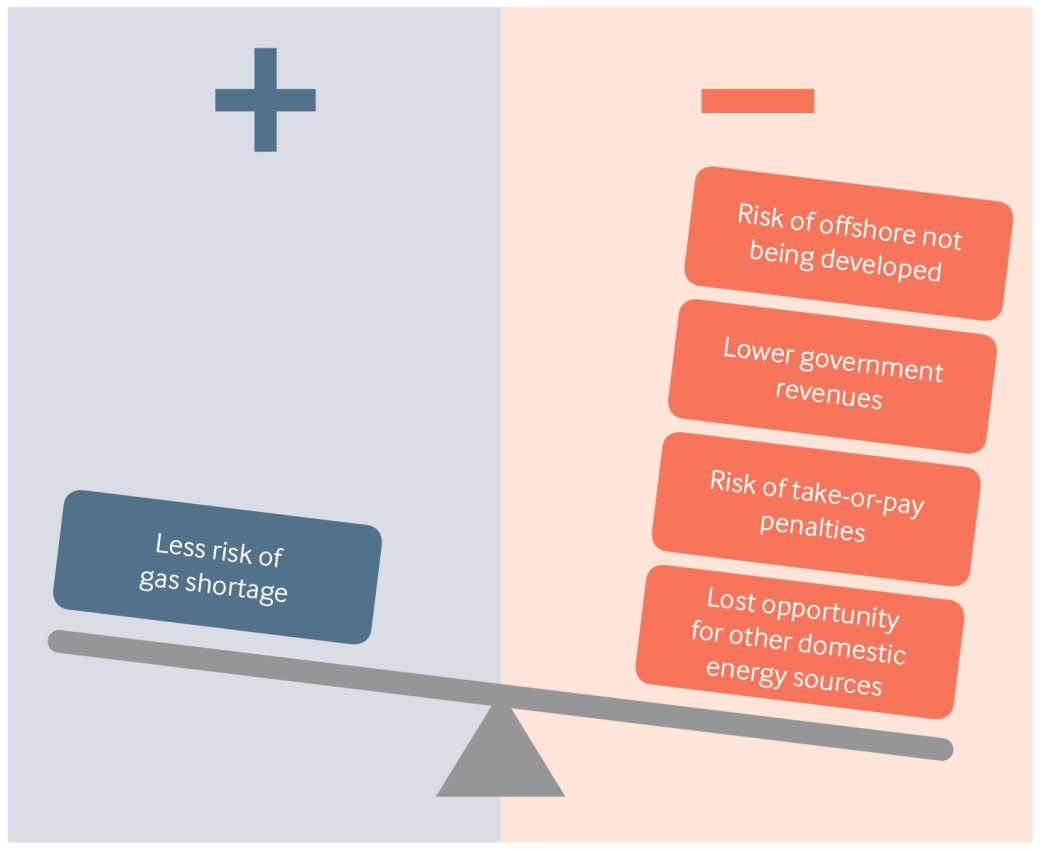

As the authors discuss in the report, the government’s concerns about a gas shortage are understandable. However, a gas surplus is a problem too—and domestic and regional demand may be lower than the government expects.

The potential costs of a DSO of even 20 percent are vast. Combined, they are almost twice Tanzania’s health budget. A DSO at that level could:

- Make an already financially precarious project less viable.

- Require tax incentives, resulting in 14 percent lower government revenue from the project.

- Risk a gas surplus, hitting the government with take-or-pay penalties equivalent to 11 percent of government revenue from the project.

To avoid such costs the government could:

- Expand the country’s energy mix to include more renewable energy, using some gas to manage power intermittency, for cooking and to supply industry, and exporting the rest.

- Negotiate a variable DSO to better fit the country’s likely demand in the future, using a revised Natural Gas Utilisation Master Plan to guide companies in redesigning the project.

- Limit the DSO to below 20 percent, given the risks to the project’s viability and the public finances.

- Support this policy by changing the public narrative from one in which Tanzania’s future is driven by gas, to one in which Tanzanians enjoy the full energy wealth of the country.

- Make the project more competitive by working with companies to reduce project costs and emissions.

Authors

David Manley

Lead Economic Analyst – Energy Transition

Thomas Scurfield

Africa Senior Economic Analyst